Outrageous Tips About How To Keep A General Ledger

To keep track of expenses:

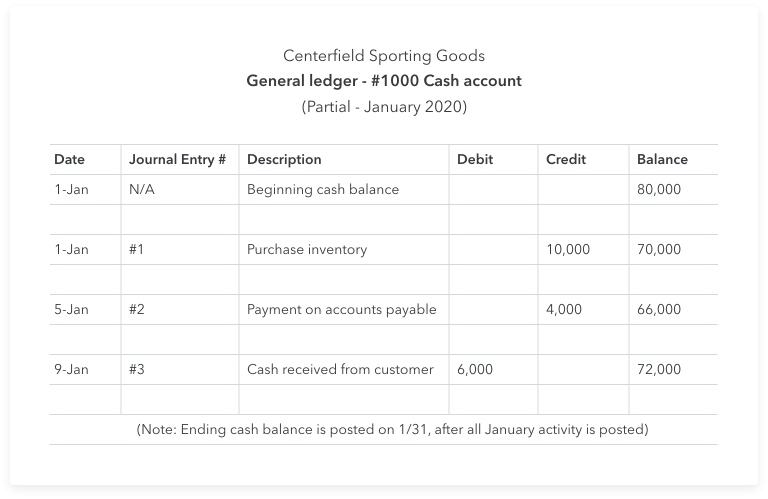

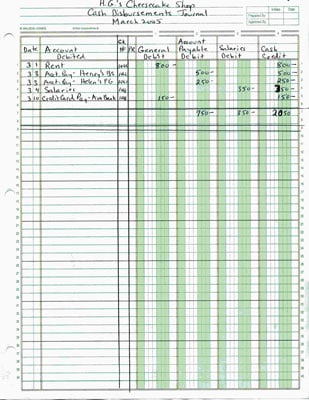

How to keep a general ledger. The first option is to set up a physical ledger in which you handwrite and calculate your transaction information. A general ledger is where all of a company’s financial activity is recorded on a monthly basis. They do this by compiling all the.

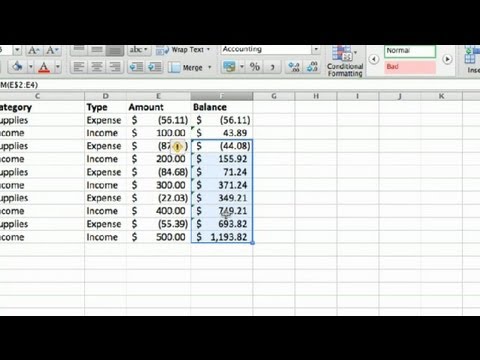

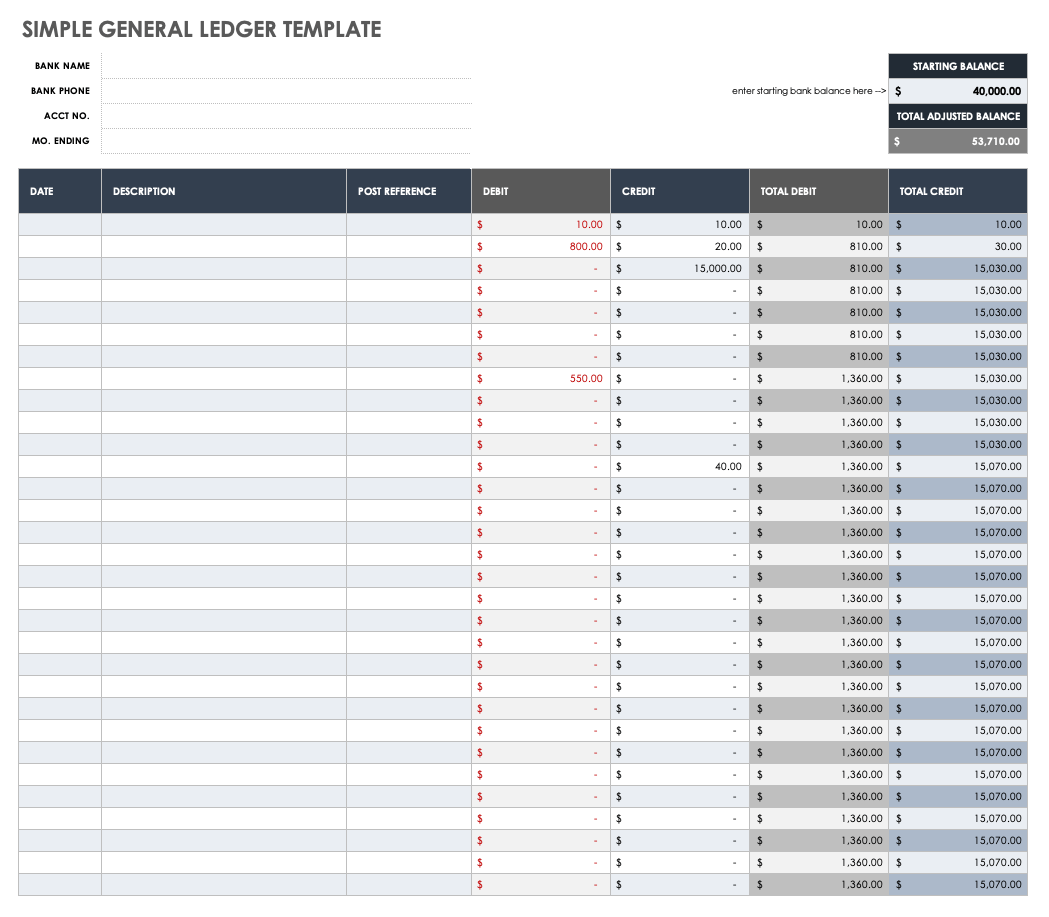

The other option is to use one of the many computer programs. A general ledger works by helping accountants balance the equation and so balance an organisation's books. Each account can then be categorized under one of these.

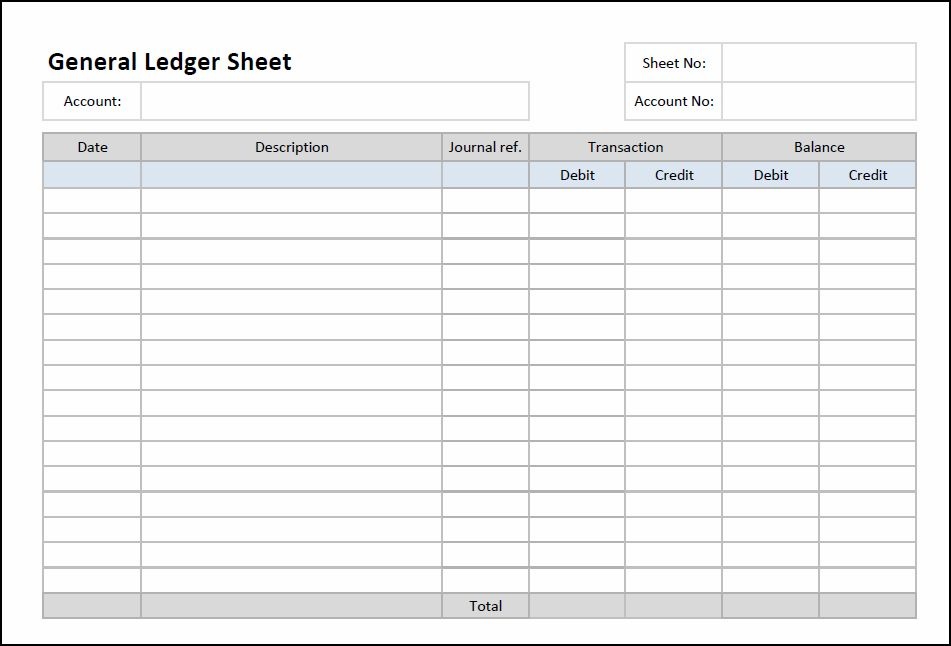

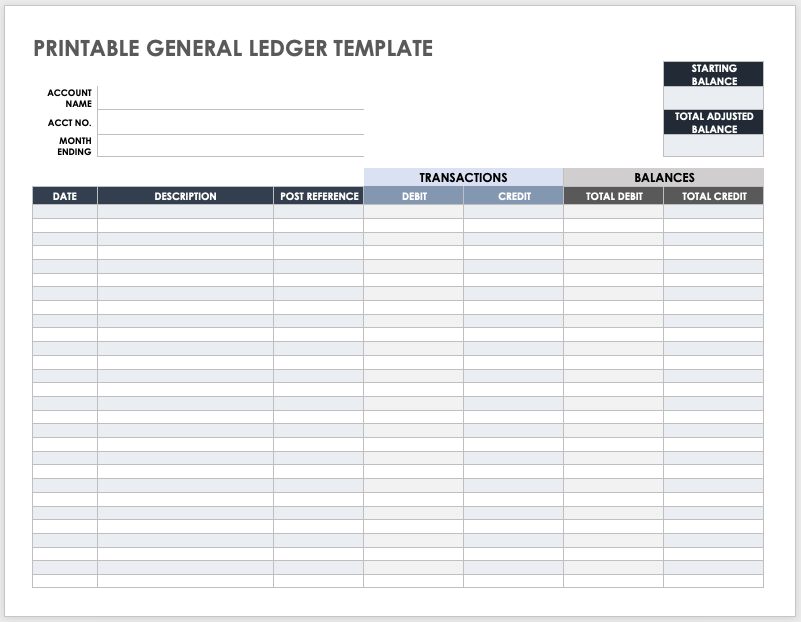

Create the initial template where you will place transactions. In the past, the general ledger was literally a ledger—a large book where financial data was recorded by hand. Write the name of the account at the top of the page so it’s easy to find later on.

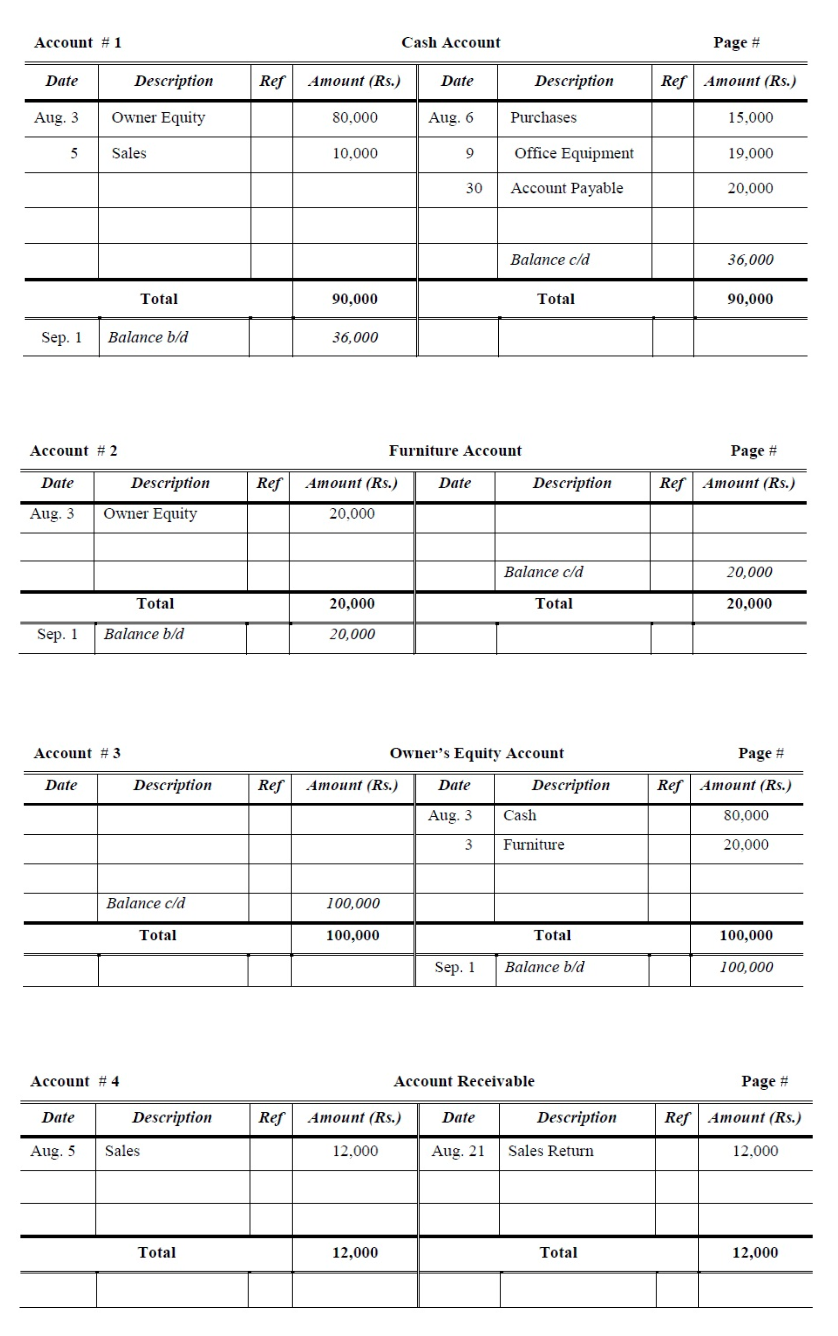

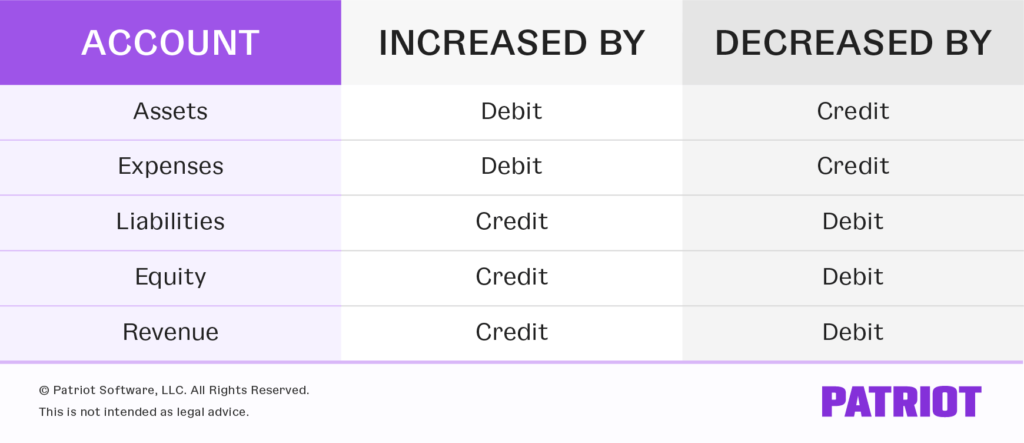

In the past, the general ledger was a large book that accounting professionals used to manually. 1) create the general ledger accounts there are five accounts that are relevant to the general ledger in a form similar to that in the table above. The general ledger uses double entry bookkeeping to keep track of all of the company’s transactions, and it is important to have a solid understanding of this concept.

Assets = liabilities + equity. They are the assets, liabilities,. Balance sheet accounts.there are three types of balance sheet ledger account categories.

In this example, we’ll use a simple table with. The general ledger (sometimes abbreviated to gl, and also known as an accounts book) is a master accounting document which allows you to see the financial position of a company as a. Of course, it’s still possible to do your bookkeeping with a paper.

Move every journal entry into its. Follow these steps to set up a general ledger for accounting in excel: The general ledger is typically going to be kept in good order by a staff member that is dedicated to the accounts.

Documenting all of your company’s transactions, including every expense, in a general ledger can make you more aware of your spending. Follow these basic steps to write a general ledger: Use a ledger to categorize and arrange transactions.

This can be a bookkeeper, treasurer, cpa, or financial director. Prepare an unadjusted trial balance.