Beautiful Work Tips About How To Correct 1099-misc

At least $10 in royalties or broker payments in.

How to correct 1099-misc. The irs will get the same copy and will know that the original 1099 is incorrect.if you already filed your return you will need to wait to see if it was rejected or accepted. Ad see how tax withholding solutions from sovos improve accuracy and efficiency. Mail copy a and the corrected transmission form (form 1096) to the.

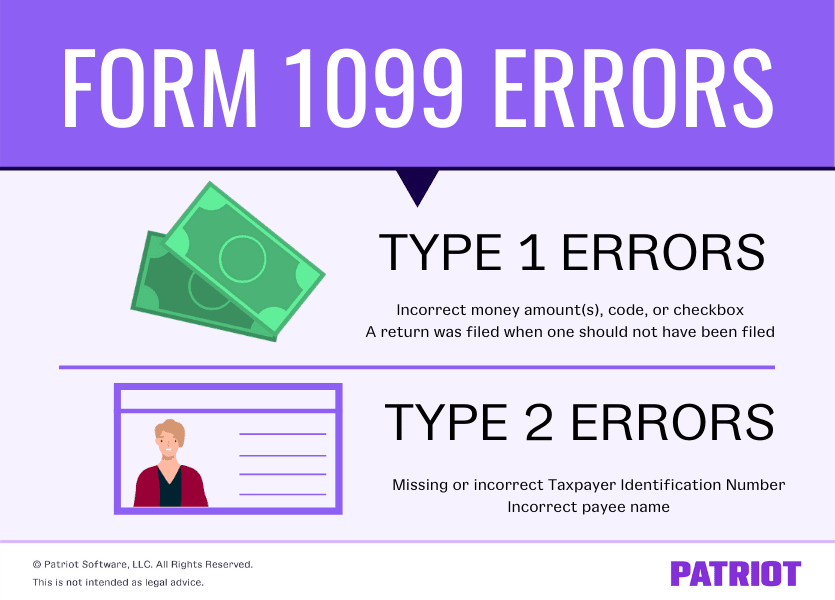

If you filed your taxes and later find that the 1099 information submitted for you is incorrect, contact the 1099 issuer. 1099 misc correction involves identifying the type of mistake or error as the first step. There are three different scenarios:

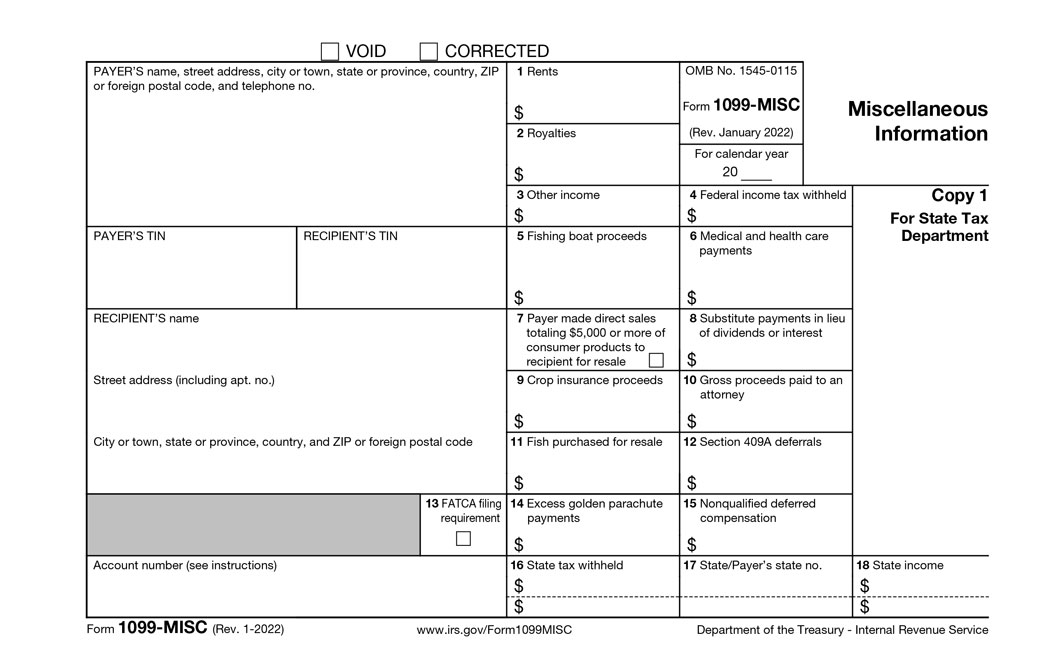

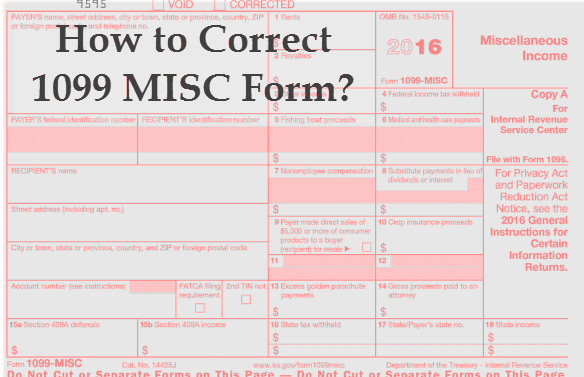

When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Possible mistakes could be a missing number, an incorrect number, name or address. The easiest errors to fix deal with an incorrect payer tin, name, and/or address.

Simply write a letter to the irs. How do i file a corrected 1099? From there you either fill out a 1096 and.

The type 1 error includes the. You, the recipient, just use the correct numbers on your tax return. If you had already filed 2016 return with the incorrect figures, you.

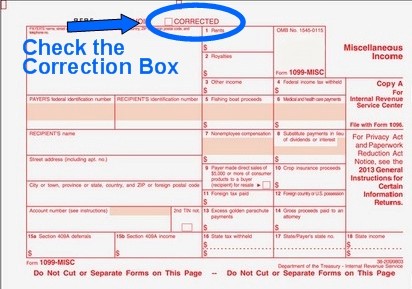

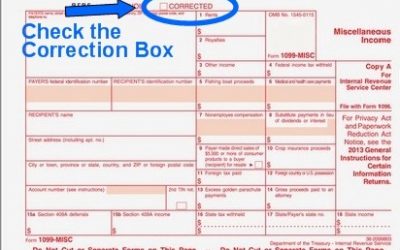

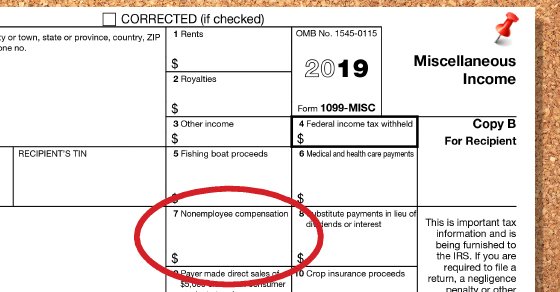

Using the recipient's id number dropdown menu, select the 1099. To add or correct, return to federal, wages and income. All you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form.

How to correct 1099 misc form? The payer files a corrected 1099 and 1096 with the irs.

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)