Out Of This World Tips About How To Be Head Of Household

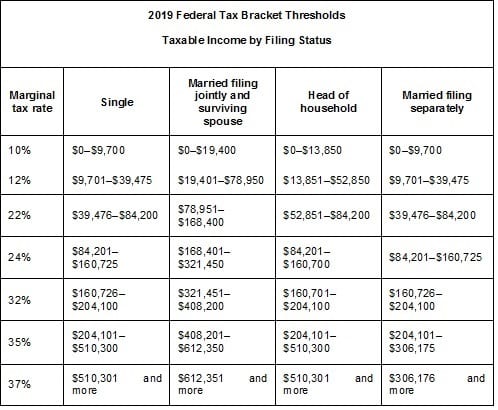

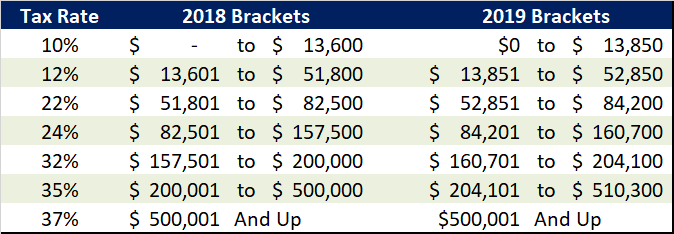

Head of household deductions and exemptions if you're single or a married person filing separately, for 2019 your.

How to be head of household. You were unmarried or considered unmarried on the last day of the tax year;. But to qualify, you must meet. This concept has been lost for many families in today’s society, but the truth remains that a man should.

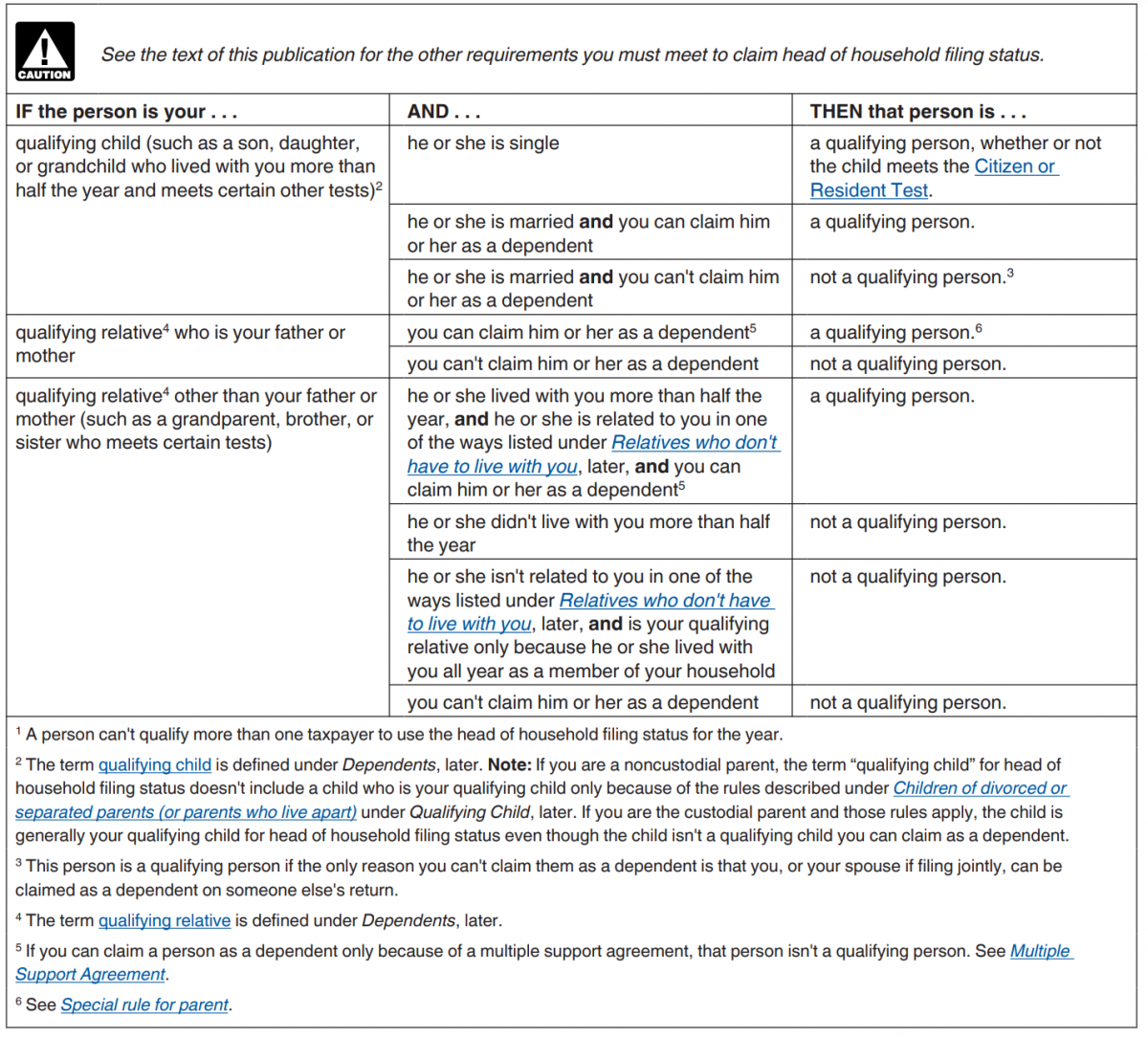

You can qualify for head of household if you: No, only one parent may claim the child as a qualifying child to file as head of household. Once you’ve established that you paid more.

You’re eligible for student loan debt relief if your annual federal income was below $125,000 (individual or married, filing separately) or $250,000 (married, filing jointly or head of. Monte had to break the tie and voted for alyssa in the end. Head of household is a filing status for individual united states taxpayers.

A husband’s role in a family is to lead his wife and children to god. A person can’t qualify more than one taxpayer to use the head of household filing status for the year. Were unmarried as of december 31, 2021 and.

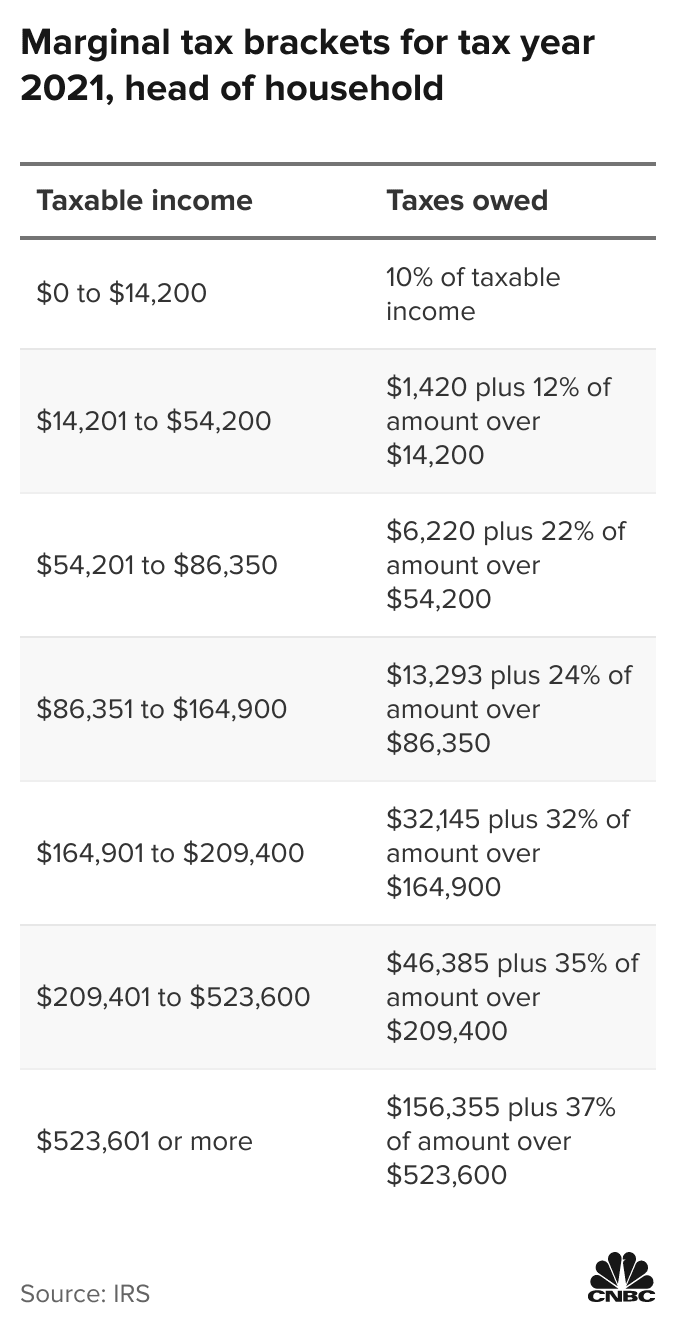

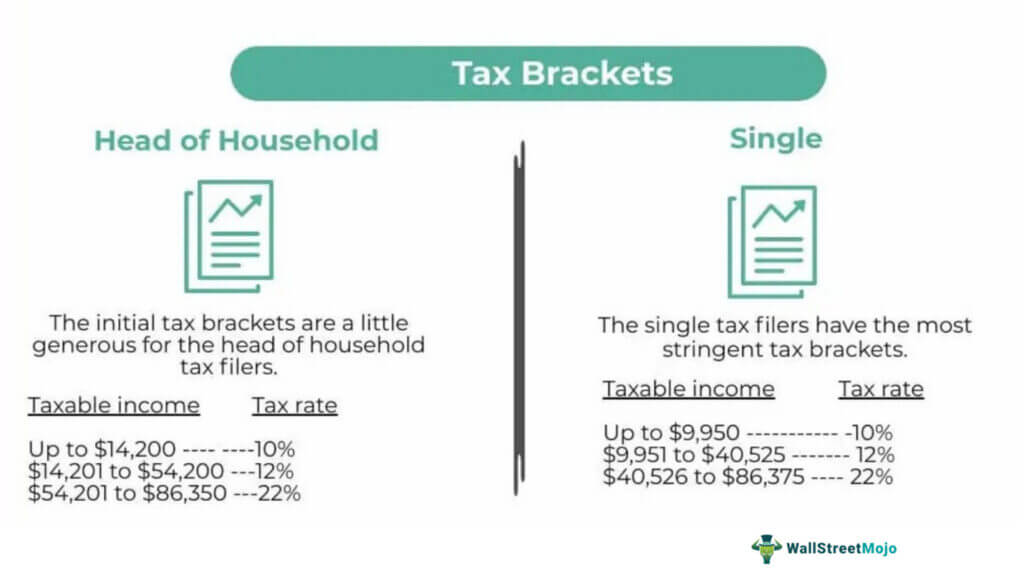

It provides preferential tax rates and a larger standard deduction for single people caring for qualifying dependents. How much do you get back for claiming head of household? To file your federal tax return as head of household, you must meet the following qualifications:

Not only did we get that ameerah blindside, but that’s the week the leftovers formed. Take stock of the major expenses for your household and start doing some math if. Head of household must be paying for at least half of household expenses in order to qualify.

For a taxpayer to qualify as head of household, he/she must be either single or unmarried at the end of the year and have maintained a home for a qualifying person such as. Head of household rules dictate that you can file as head of household even if you don’t claim your child as a dependent on your return. With a new week of big brother starting on finale night, the remaining houseguests taylor, monte, turner and brittany participated in the new head of household competition.in.

You can only claim head of household if you paid more than half, which would be 51% or more of your total household expenses. Should pay over 50% of the costs to support the house. Paid more than half the cost to run your (or a qualifying parent's) home this year.

You have to qualify for head of household. As far as the children are concerned, a mother and father working together are the heads of the household. From that moment on, the final four was installed,.

Three basic rules determine if a taxpayer qualifies for the head of household filing status, and you must meet all of them. (rent, utilities, groceries, etc.) should live with a qualifying member of the. To qualify for head of household on your tax return, you must be unmarried or considered unmarried by the irs and live with a qualifying person that you can claim as a.

:max_bytes(150000):strip_icc()/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png)