Peerless Tips About How To Be A Independent Contractor

Relevant bachelor's degree and /or certifications 2.

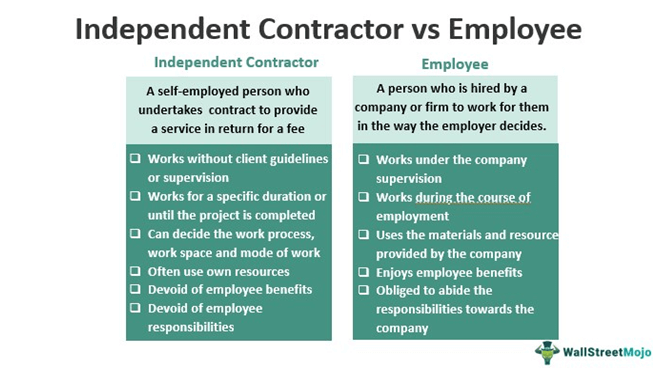

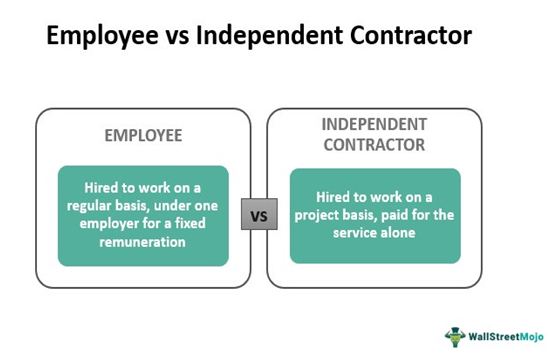

How to be a independent contractor. With an independent contractor, one is paying for a product or result. How to become a nurse independent contractor 1. An independent contractor is a person who is in business on their own account.

Independent contractors are free from: Once you have a business. Generally, independent contractors do the job as they see.

An independent contractor will submit an invoice when they need to be paid. How do you become an independent contractor? A portfolio of your previous work to show that you have successfully han… see more

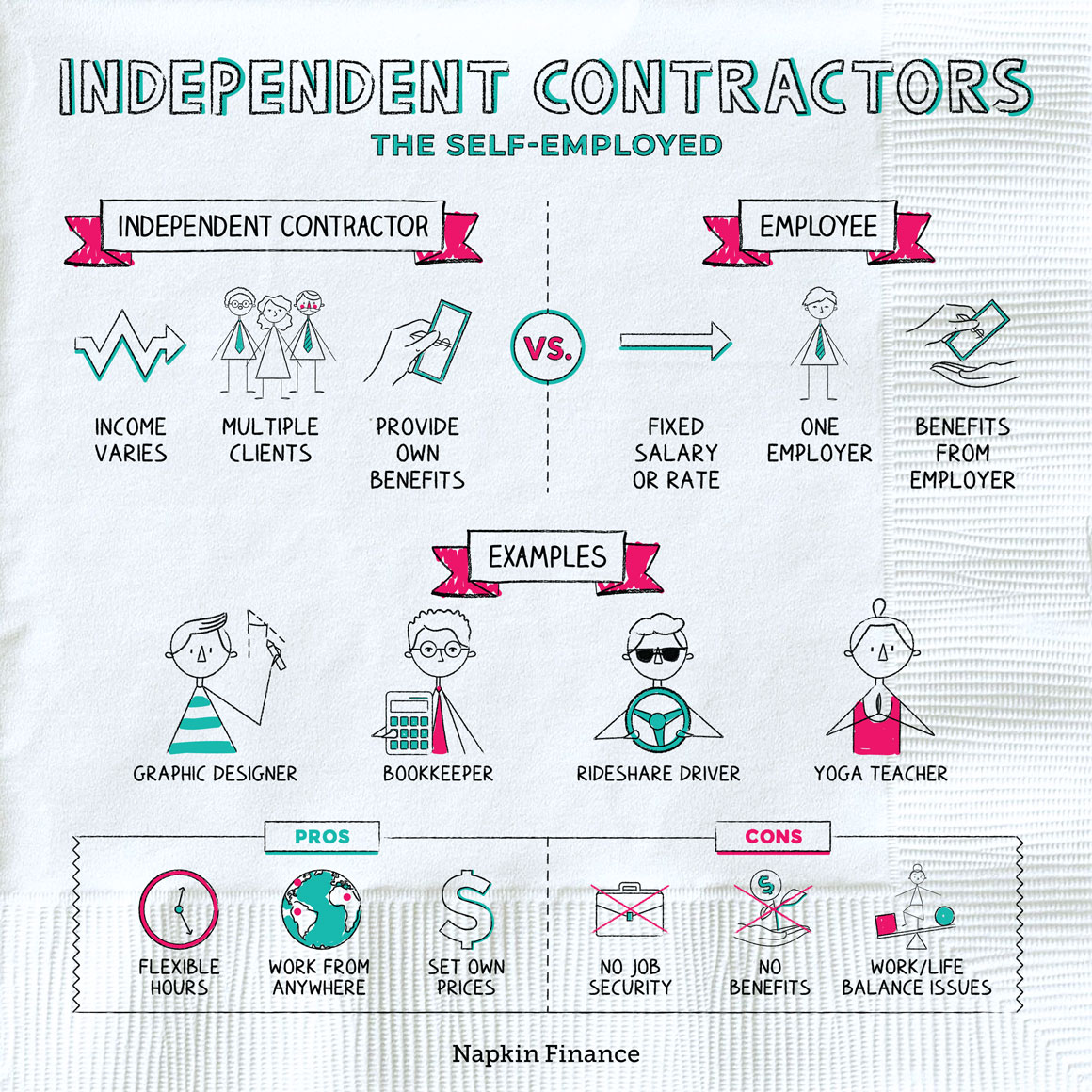

If an independent contractor doesn't get. You may need to file a fictitious name (trade name or d/b/a) statement if your business name is different from the name of your company. You define the work hours:

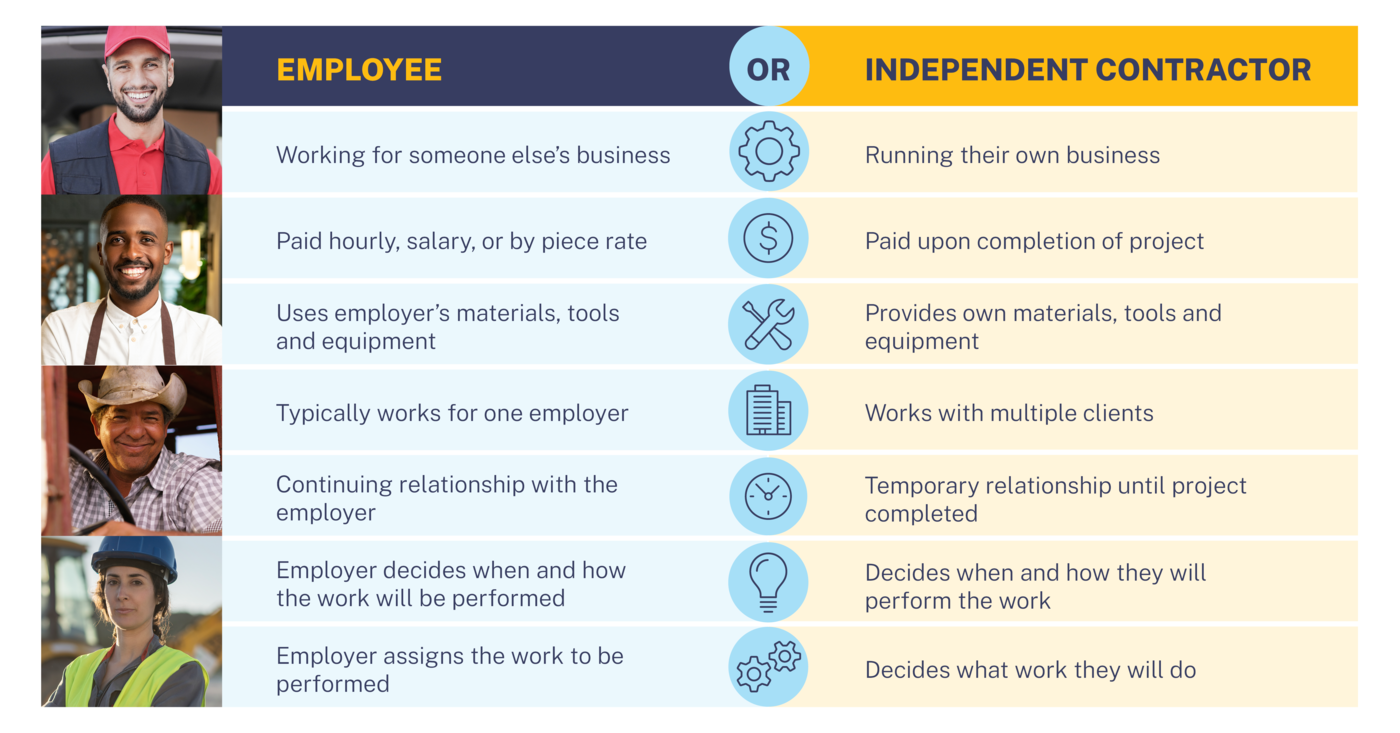

Being hired as an independent contractor is when a company employs someone under contract to perform a specific service. They are in business for themselves, offering their services to the general public. Free from control or direction from hiring agent.

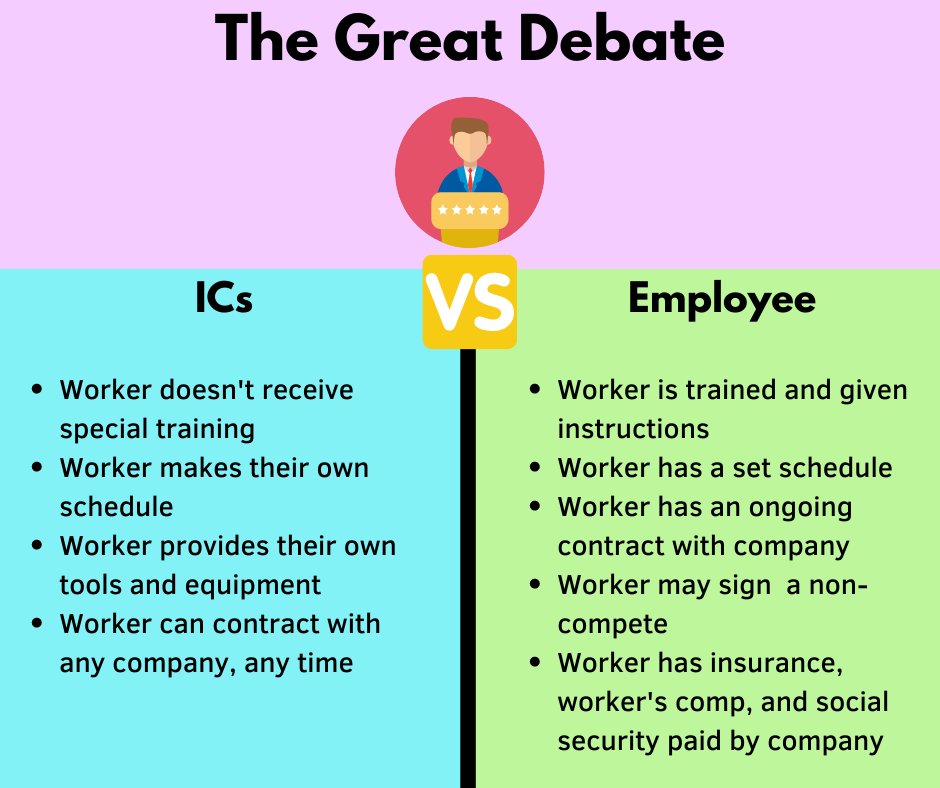

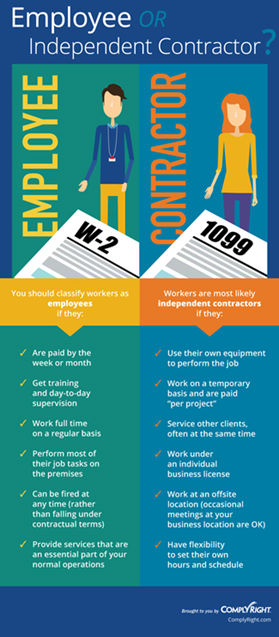

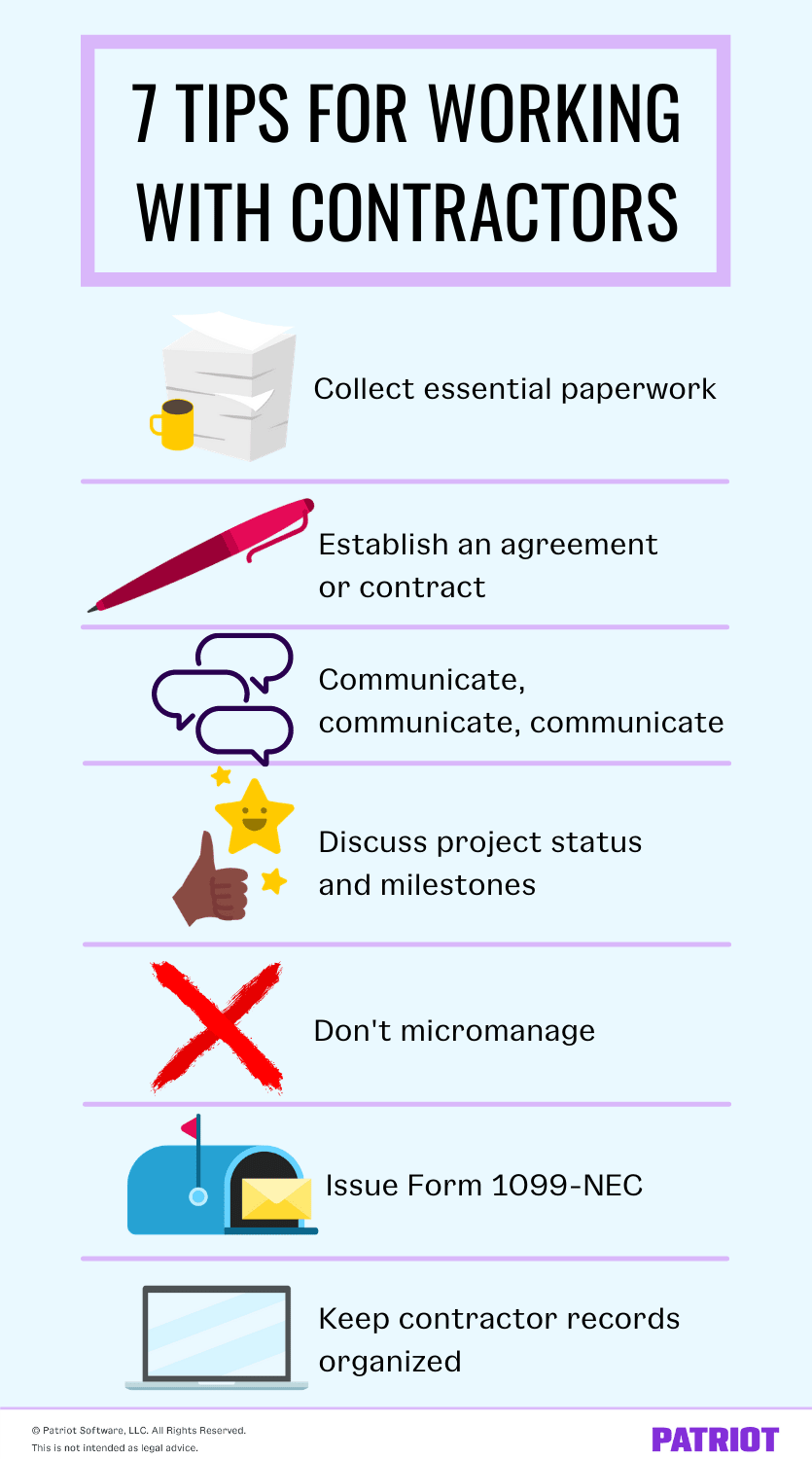

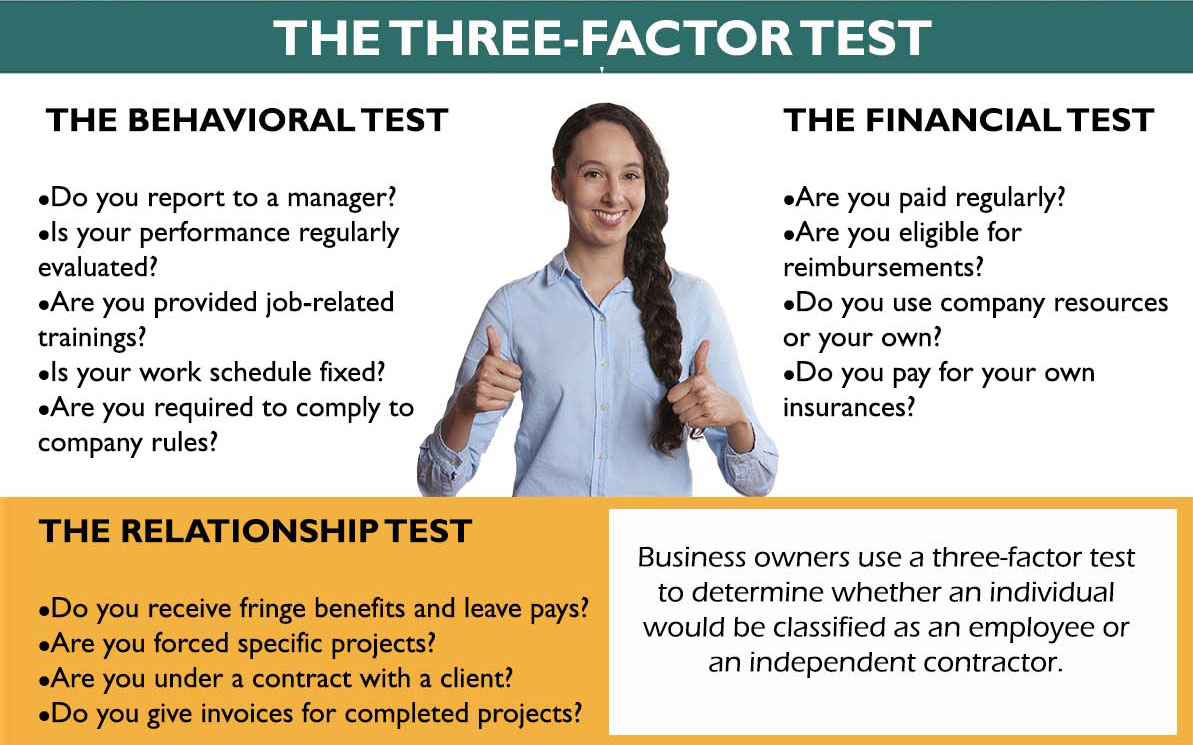

Here are seven warning signs your contractor might actually be an employee under the law: The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. An independent contractor receives compensation in one of several methods, depending on the agreement set up between your company and the contractor:

Engaged in their own independently established business, occupation, trade, or. Most employers provide training for. An independent contractor is anyone who does work on a contract basis to complete a particular project or assignment.

An associate degree in nursing, called an associate of science in nursing or associate of. Control in the performance of their duties. The more you can present yourself as a legitimate independent contractor, the more attractive and easier to hire you’ll be.

Unlike an employee, an independent contractor completes the work assigned with. They can be paid on a regular basis or at the end of the contract or project. An independent contractor occupation can be any type.

Employers usually cover half of fica. Start by calculating your taxable income after deductions. It is important to remember that an independent contractor operates in a professional or business context.